3 HS Codes To Know Before Importing Silver or Gold into Malaysia

Now that you have decided to import silver or gold into Malaysia, it is crucial that you understand HS code for importing.

Now that you have decided to import silver or gold into Malaysia, it is crucial that you understand HS code for importing.

HS code stands for “Harmonized Commodity Description and Coding System”. HS code is the global standard for classifying trading products. It is maintained by World Customs Organization (WCO). More than 98% of world trade uses it, so it’s really important!

3 HS codes that you must know on importing precious metals into Malaysia

HS Code #1: 7108 spells easy Gold.

HS Code #2: 7106 is for Silver.

HS Code #3: 7118 is BAD NEWS for Silver!

—–

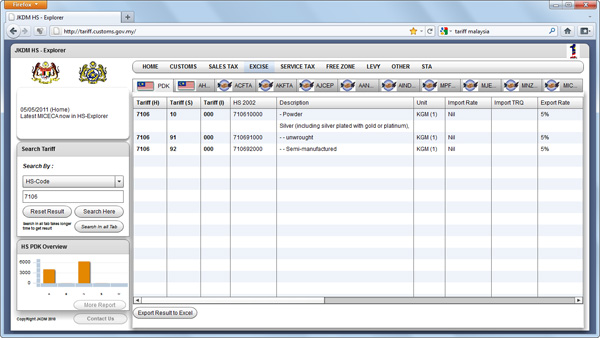

^ Screen capture from http://tariff.customs.gov.my website

To check details on what the codes mean, go to http://tariff.customs.gov.my and key in the codes. The website uses Flash so make sure your browser are able to view using the latest Flash. Ipad won’t work. Ipad 2 won’t work either.

On the other note, if you find that the code you entered doesn’t work; remove the trailing “space” from your code and try again.

HS Code #1: 7108 spells easy Gold

Easiest of all precious metal. Free from taxes and duties for both way, importing and exporting. In short, gold is tax free, period.

HS Code #2: 7106 is for Silver

It’s tax free to import Silver too! Exporting Silver however is subject to 5% export duty.

^ Screen capture from http://tradepoint.org website

HS Code #3: 7118 is BAD NEWS for Silver!

Silver coin is definitely NOT tax free. This is the tricky part. While silver bars are being classified under HS code 7106, silver coins are not. It is clearly stated that “Coin (other than gold coin), not being legal tender” is subject to import duty of 5% and sale tax of 10%.

What does “not being legal tender” means to us?

In Malaysia, only products issued by Bank Negara has legal tender. Therefore, by default, all coins not issued by Bank Negara will be “not legal tender” in Malaysia.

In short, if you import any silver coin bullion with any monetary value backed by any government on it, it is subject to taxation. These include American Eagles, Canadian Maples, Australian Transformers and Chinese Pandas.

Conclusion:

Gold is the easiest import of all precious metals. You can bring in a container load of gold and sign your import declaration paper for free. Silver on the other hand is free tax to import ONLY if it is not coin. With that, it’s cheaper to invest in silver bar directly. If you are attracted to those beautiful bullion coins, be prepared to pay 15% premium for it. So long you don’t sell it overseas, it should be fine.

Happy investing!

References:

Reference #1: http://tariff.customs.gov.my

Reference #2: http://tradepoint.org

Reference #3: http://en.wikipedia.org/wiki/Harmonized_System

There's 17 Comments So Far

August 3rd, 2011 at 9:35 pm

Thanks for your informative articles. Can you please detail the step by step way to import silver? I tried using Apmex but not working. Many online sites don’t ship to Malaysia! I want to buy per order about 100oz to 200oz or either 1oz bars or 10oz bars. Which dealer/mint or website would you recommend please? Kitco don’t sell 1oz or 10oz bars at the moment. Tks.

August 3rd, 2011 at 10:46 pm

With 100oz to 200oz, you can try buying directly from kitco.com. All the best!

August 3rd, 2011 at 10:58 pm

Kitco.com don’t sell 1 oz or 10 oz bars now. I mean I want to buy 100 to 200 of 1 oz bars or 10 to 20 of 10 oz bars to make 100 to 200 oz per purchase. I don’t want to buy big 100oz bars, which Kitco is selling now. So where else can I get the smaller 1 oz or 10 oz bars in the quantity that I want per order. Tks !

August 3rd, 2011 at 11:17 pm

Try this http://www.gainesvillecoins.com/category/405/generic-silver-bars-and-rounds.aspx 🙂

August 24th, 2011 at 7:56 pm

Can you tell me how to use the HS code? Izzit show this HS code to the Customs once my parcel been blocked by them for Tax charges? or I should show this HS Code before I order silver from foreign country?

August 25th, 2011 at 12:41 pm

When importing, the supplier usually will do the declaring. It is up to the custom department’s judgement on which hs code to tax you.

August 27th, 2011 at 3:37 am

Thanks you so much for wonderful info here!

February 18th, 2012 at 2:54 am

I’ve been buying locally from http://www.silvermalaysia.com

Fast shipping and they are one of the few that carry the Scottsdale Silver bars

FL

February 18th, 2012 at 4:04 pm

We also carry the Scottsdale Silver Bar which you can buy from our webstore at https://buysilvermalaysia.com 🙂

May 1st, 2012 at 1:37 pm

In Malaysia, only products issued by Bank Negara has legal tender. Therefore, by default, all coins not issued by Bank Negara will be “not legal tender” in Malaysia.

In short, if you import any silver coin bullion with any monetary value backed by any government on it, it is subject to taxation

I quoted this from above.

what about let say…apmex silver round..is it counsider as coin…it dont have legal tender in any country…no face value.. so is it taxed 15 %?

May 1st, 2012 at 1:40 pm

So long there is no monetary value stamped onto the coins, it is tax free. Silver rounds are tax free. However, I was told that it is subject to the tax officer on duty. There have been reported dispute cases on silver rounds where importer was taxed in regardless. All the best in your silver investment. Cheers 🙂

October 15th, 2012 at 1:26 am

i’m confuse about how the custom declare the silver coins code..1’m buying some australian kooaburra about 2 weeks ago and there was no tax aligible for me…

for next purchace i’m buying 1 tube of ASE and suprise that i had to pay 300 ringgit for taxes..how can it be?

October 16th, 2012 at 10:10 am

Dear Ikram,

The custom department may have overlooked on your small amount of Australian coins. For a tube of ASE, it is legally taxable. As stated, ASE have a legal tender value backed by US government. Hence it is classified under coin, HSCODE 7118.

February 9th, 2014 at 7:55 pm

May i know how about hand carry the silver coin back to malaysia

is that tax will be charged ?

August 6th, 2014 at 11:37 am

Technically, it is really up to the custom officers. Small amount should be ok, but 500 ozt of it is not 🙂

Who Linked To This Post?