Gold-to-Silver Ratio: What you need to know

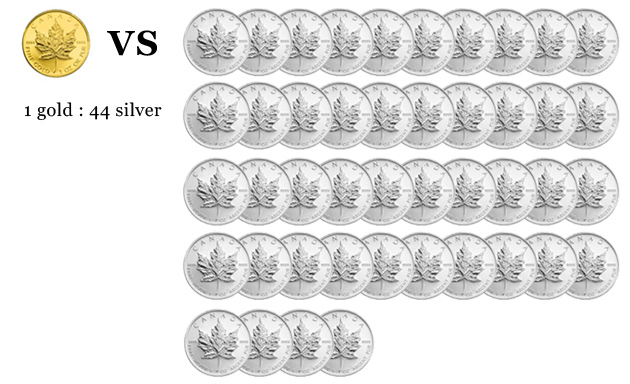

The first thing you need to know about gold to silver ratio is 1 unit of gold buys 44 unit of silver today.

^ Ratio of Gold:Silver on 17th August 2011

Definition:

“A ratio (X:1), demonstrating how many ounces of silver (X) it takes to purchase one ounce of gold – the fixed variable. Investors use the fluctuating ratio to evaluate the relative value of silver, which determines if it’s an optimal time to purchase gold or silver. It also helps investors diversify their precious-metal holdings.” – investopedia.com

The gold silver ratio is calculated by dividing the price of gold by the price of silver. The declining gold silver ratio indicates that silver has been outperforming gold. The smaller the number, the better for silver. The gold silver ratio has declined from historical high of 100 in 1991 before coming to current level of 44.

^ 10 years Ratio of Gold to Silver

While it takes 44 oz of silver to buy 1 oz of gold, the production ratio of silver to gold is 10:1. We used to have 10 billion ounces of above ground silver in 1940. Today, we have an estimated of 1 billion ounces of above ground silver. 90% of it was consumed by industrial activities. Gold on the other hand, stands at 5 billion ounces. Almost all gold ever mined still exists today. Gold recycling is common while silver recycling is not. It is unrealistic to extract small amount of silver from junk electronics and thrown microchips.

Before 2006, China was exporting 100 million ounces of silver worldwide. Today, China is importing 14% of the global silver production.

In short, the current gold to silver ratio clearly states that silver is undervalued. With silver shrinking on a daily basis due to high industrial demand, gold to silver production ratio will continue to close the gap.

Say if we based on current production ratio of 1:10, gold trading at USD$1,780 today would translate to silver hitting $178!

Let’s discount this and set the ratio to the historical value of 1:16.

Gold today is $1,780/oz, silver will be $111.25!

From $44/oz to $111.25/oz, that’s 152.8% worth of potential upside!

When gold hits $2,000/oz, silver will be $125!

From $44/oz to $125/oz, that’s 184% worth of potential upside!

When gold hits $2,500/oz, silver will be $156.25!

From $44/oz to $156.25/oz, that’s 255%!

There's 0 Comment So Far