Posted by KH »

2 Comments »In my previous post last year, I wrote about two HS-codes that every silver investor has to know; HS-code 7106 and HS-code 7118. If you have yet to read it, you can read it here: 3 HS Codes To Know Before Importing Silver into Malaysia.

Popular silver coins such as Canadian Maples, American Eagles and Austrian Philharmonic all fall under HS-code 7118. They are subject to import duty of 5% and sale tax of 10%.

In event your shipment got caught up by the Custom Department, chances are, you need to do clearance for it. You can either opt for Pos Laju or any forwarding agents of your preference to do it on behalf of you for a fee -or you can do it yourself.

So, how much is the tax actually?

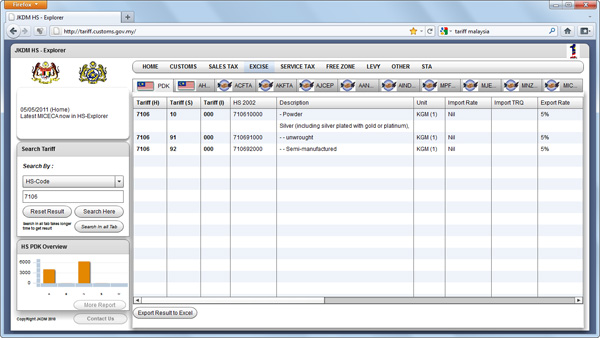

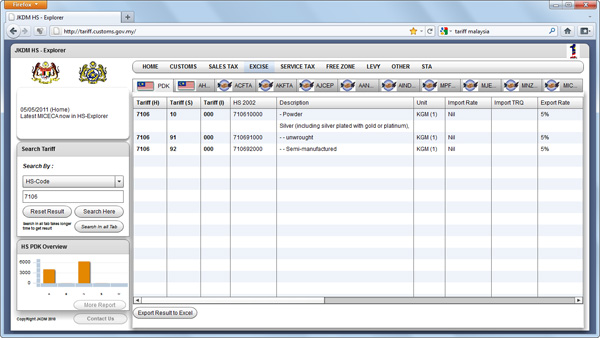

Customs.gov.my stated that “Coin (other than gold coin), not being legal tender” is subject to import duty of 5% and sale tax of 10%.

^ http://tariff.customs.gov.my website

Thus, 15% aye? Not quite. You may be suprised.

[Read more →]

Posted by KH »

Add Comment »GainesvilleCoins.com today sent me an email with a title “GainesvilleCoins.com – International Customer Notification”.

^ Screen captured from GainesvilleCoins.com’s email notification 28th Sept 2011

The recent sell off must have been really ugly for GainesvilleCoins.com to come up with such unfavorable policy. GainesvilleCoins.com is highly recommended by National Inflation Association for their wide varieties of product and fair margin price.

Posted by KH »

11 Comments »Its Friday today and I am going to make this post K.I.S.S.

Here are five quick tips for buying and investing silver in Malaysia:

Tips #1 – Buy Silver Bars

Silver bars are imported under HS-code 7106. Silver coins are under HS-code 7118. HS-code 7118 says, “Coin (other than gold coin), not being legal tender, is subject to import duty of 5% and sale tax of 10%”.

Buy silver bars and skip the 15% import tax premium.

Tips #2 – Go Bigger Oz

Buy 1 x 10 oz bar instead of 10 x 1 oz bar. Buy 1 x 100 oz instead of 10 x 10 oz. The bigger oz you buy, the bigger saving you get on minting. Scottsdale Silver’s 10 oz and 100 oz comes with a cool stacking feature.

[Read more →]

Posted by KH »

17 Comments » Now that you have decided to import silver or gold into Malaysia, it is crucial that you understand HS code for importing.

Now that you have decided to import silver or gold into Malaysia, it is crucial that you understand HS code for importing.

HS code stands for “Harmonized Commodity Description and Coding System”. HS code is the global standard for classifying trading products. It is maintained by World Customs Organization (WCO). More than 98% of world trade uses it, so it’s really important!

3 HS codes that you must know on importing precious metals into Malaysia

HS Code #1: 7108 spells easy Gold.

HS Code #2: 7106 is for Silver.

HS Code #3: 7118 is BAD NEWS for Silver!

[Read more →]

Posted by KH »

1 Comment » If you are a fan of Transformers, you might be interested in these. Yes, not only does dark moon has Transformers, Perth Mint Australia has them too! You can order them directly at Perth Mint’s website.

If you are a fan of Transformers, you might be interested in these. Yes, not only does dark moon has Transformers, Perth Mint Australia has them too! You can order them directly at Perth Mint’s website.

It cost AUD$299 to buy them today. Convert that to with today’s rate against Australian dollar of 3.25, it’s about RM971.75. You can have them directly shipped to your Malaysian address but it’s subject to 5% import and 10% sales tax (approx RM145.76). With that, your total cost rounds up to RM1,117.5. That’s about RM372.5 for one piece of Optimus Prime coin.

[Read more →]

Now that you have decided to import silver or gold into Malaysia, it is crucial that you understand HS code for importing.

Now that you have decided to import silver or gold into Malaysia, it is crucial that you understand HS code for importing.  If you are a fan of Transformers, you might be interested in these. Yes, not only does dark moon has Transformers, Perth Mint Australia has them too! You can order them directly at

If you are a fan of Transformers, you might be interested in these. Yes, not only does dark moon has Transformers, Perth Mint Australia has them too! You can order them directly at