GoldSilver2u.com’s High Premium and Wide Spread Gap

Back in November 2011, I reviewed GoldSilver2u.com’s above spot premium as well as their buyback spread. Just recently, I had an conversation with a reader of mine and we touched the topic of GoldSilver2u.com. I had a rude shock when I realized the premium and spread for GoldSilver2u.com has widen – in a big way!

Today, we are going to pay GoldSilver2u.com a revisit. Armed with my faithful calculator, we are going to revised our previous calculation on GoldSilver2u.com’s pricing. At current point of writing, the international spot price for silver is USD$34.78.

Back to November 2011: Premium Above Spot

^ Screen capture from GoldSilver2u.com on 26th Nov 2011

Refering back to the previous screen capture I made in 26th November, let us calculate the premium above spot back then.

| # | Product | Price | Spot Price | Difference | Above Spot % |

|---|---|---|---|---|---|

| 1. | PAMP SUISSE 999 | 4,060.13 | 3,250.00 | 1,183.25 | 24.92% |

| 2. | TWIN TOWER 999 | 1,242.90 | 1,010.75 | 232.15 | 22.96% |

Premium above spot in between 22% – 25% is acceptable.

Forward to March 2012 – Current Premium Above Spot

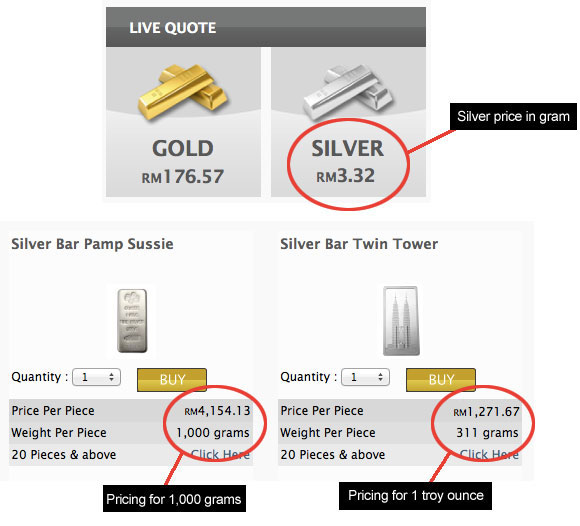

^ Screen captured from GoldSilver2u.com on 3rd March 2012

| # | Product | Price | Spot Price | Difference | Above Spot % |

|---|---|---|---|---|---|

| 1. | PAMP SUISSE 999 | 4,583.25 | 3,400.00 | 1,183.25 | 34.80% |

| 2. | TWIN TOWER 999 | 1,457.07 | 1,057.40 | 399.67 | 37.80% |

Considering Malaysia does not have import tax on silver bars, there is no reason for such high premium. Bare in mind that we are dealing with decent weight here (10oz and 1kg), not silver bars of one ouncers.

I would give it for PAMP Suisse as it is always known as the Rolls Royce of silver bars but 37.80% above spot price for TWIN TOWER silver bars? Really?

[Read more →]