EU dipping hand into Cyprus Depositors Cash in their Banks!

Recent headlines are mainly focused on the potential bailout plan in the Republic of Cyprus, a member state of the European Union. Over 7o% of its 1.1million population is ethnic Greek, maybe that is the reason so often mistaken to be part of another country in financial crisis, Greece.

“The entwinement of Cyprus and Russia, the world’s ninth-biggest economy, makes things complicated. Russia’s banks and companies have $31 billion parked in Cypriot banks, according to estimates by Moody’s Investor Services” – Bloombarg Businessweek

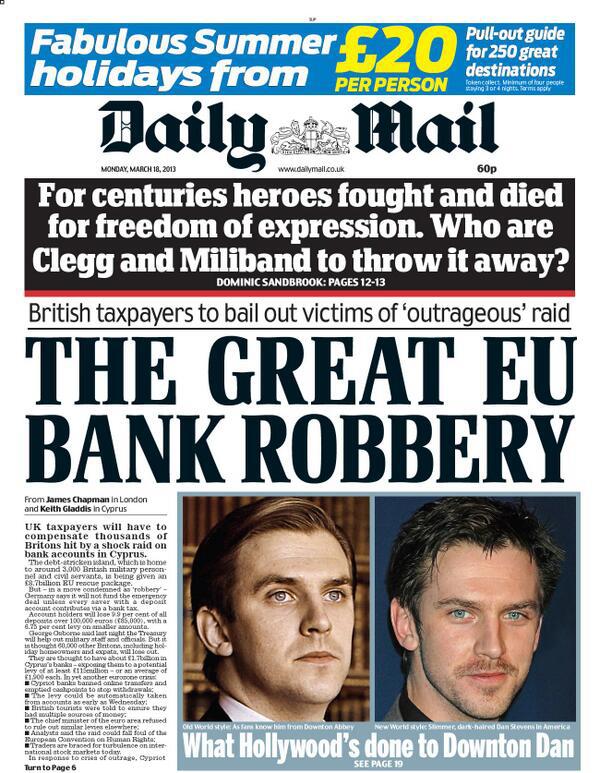

The €10 billion bailout package by EU includes a tax on cash in the local banks, affecting both local residents and foreign companies that engage loans and cash deposits. This forced the Cyprus Government to declare ‘bank holiday’ until Thursday. The speaker of the Cyprus Government confirmed that a seating on Thursday is scheduled to discuss on the bailout proposal. This had caused residents to make a beeline to the ATM (teller machines) to withdraw as much cash as possible, prior the announcement. This is what we term as ‘bank run‘.

^ Rush to withdraw cash seen during the recent Lahad Datu Army Deployment two weeks ago

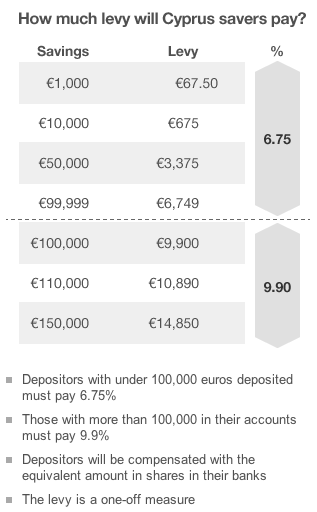

The plan of the bailout is not straightforward as previous bailouts, this time as proposal to tax current depositors in bank as much as 9.9% for balances over €100,000. Some rumour speculate it to be 15% for over €500,000. This sparked outrages within people in Cyprus, Europe and surprisingly Russians.

“Almost €6 billion of the savings for taxpayers in euro-zone countries came from losses imposed on depositors in Cyprus’s outsize banks. A one-off 9.9% levy will be imposed on all deposits over the insurance threshold of €100,000 before banks reopen after a bank holiday on Monday.” – The Economist

“Cypriot banks took in billions of euros in deposits, including from Russian oligarchs who’ve set up business on the Mediterranean island nation. Naturally, they had to put all that money to work somewhere. Reaching for attractive returns, they invested depositors’ money heavily in Greek loans and bonds—and took a beating when Greece’s economy skidded.”

Bailout or bankruptcy?

Without financial support from somewhere, Cyprus will be unable to meet its financial commitments. Why? The country’s outsized banks have been crippled by losses on Greek debt, and it can’t afford to bail them out on its own.

The country’s debt-to-GDP ratio, currently around 87%, is on course to soar to an unsustainable 140% without a bailout. A messy default could lead to exit from the eurozone and revive fears about the viability of the currency area.

“A disorderly bankruptcy would have forced us to leave the euro and forced a devaluation,” Cyprus President Nicos Anastasiades said Sunday. – CNNMoney

Stay tuned.

There's 0 Comment So Far