Yay! Gold went $1600! All time high! So what about Silver?

I received 2 messages from my MSN messenger yelling in joy, “Gold hit $1,600 an ounce! WOW!”… A quick check into my inbox and I have few newsletters on gold hitting the new high of $1,600/oz as well. So, what’s the big deal really?

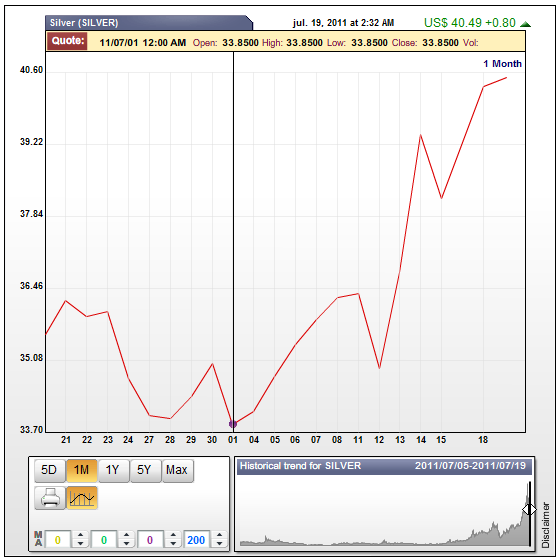

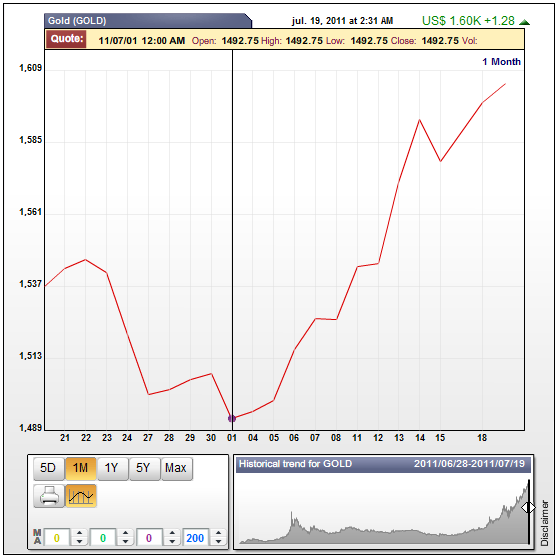

^ Screen capture from goldprice.org website.

Everybody is expecting gold to go further than $1,600. Do a quick google search and you’ll probably see pages of prediction of gold hitting $2,000, $2,500 or even more than $3,000 an ounce. So really, what’s there to shout when it’s $400 short from the $2,000 target?

Now let’s put on our counting cap and calculate the actual upside for gold from a percentage perspective. I will take 1/7/2011 as benchmark as gold was retreated to it’s lowest of $1,492.75/oz from the previous peak of $1,546/oz before climbing up to the record high.

From the chart, we can see that gold went down to it’s lowest at $1,492.75 before bulling all the way up to $1,600. That’s $107.25 north! Great! A few quick punches on the calculator and we get an upside of 7.18%! WOW!

Let’s see how does the poor man’s gold fare over the same period.

Like gold, silver was corrected and went south to $33.85/oz from it’s previous tiny peak in June of $36.36/oz. The day gold hit $1,600, silver followed with a $40.64/oz finish. That’s $6.79 an ounce gain. Against the gold’s $107.25 gain, $6.79 is probably just spare change. A few quick punches on the calculator and voila, we get a 20.05% upside! It was not a new high for silver thus there weren’t any celebrations for the penny. I did not receive any newsletters on it too.

In short, over the same period, silver out-performed gold by 2.79 times!

2.79 times!

Now, shall we pop the champagne?

There's 0 Comment So Far