Importing Silver into Malaysia: 15.5% Effective Tax

In my previous post last year, I wrote about two HS-codes that every silver investor has to know; HS-code 7106 and HS-code 7118. If you have yet to read it, you can read it here: 3 HS Codes To Know Before Importing Silver into Malaysia.

Popular silver coins such as Canadian Maples, American Eagles and Austrian Philharmonic all fall under HS-code 7118. They are subject to import duty of 5% and sale tax of 10%.

In event your shipment got caught up by the Custom Department, chances are, you need to do clearance for it. You can either opt for Pos Laju or any forwarding agents of your preference to do it on behalf of you for a fee -or you can do it yourself.

So, how much is the tax actually?

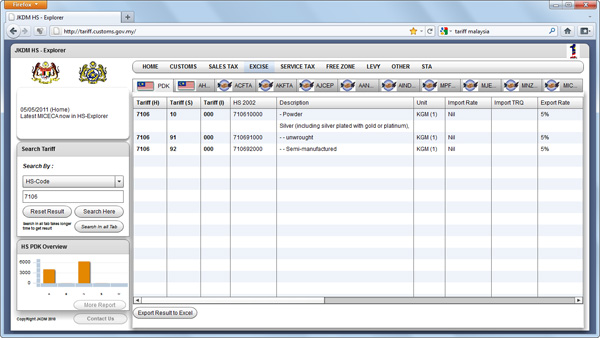

Customs.gov.my stated that “Coin (other than gold coin), not being legal tender” is subject to import duty of 5% and sale tax of 10%.

^ http://tariff.customs.gov.my website

Thus, 15% aye? Not quite. You may be suprised.

Bring in the Abacus!

Let’s take a case study below and work out the maths.

For a start, say you have a box loaded with of some nice American Eagle silver coins worth USD$500.

Do note that, taxation takes in shipping and insurance cost as well. So, in this case, we shall just assume shipment and insurance cost is USD$85. With that, your taxable figure is USD$585.

Firstly, apply the 5% import duty on it, USD$585 x 5%, thus: USD$29.25 for import duty.

For sale tax, it is a compounded tax. Instead of taking USD$585 for sale tax, you take the sum of USD$585 + USD$29.25. Therefore, it is USD$614.25 X 10% = USD$61.425.

Your total payable tax amount is now USD$29.25 + USD$61.43 = USD$90.68/=.

Walk to the clearance cashier and kaching, pay the total of RM290.16 which is an estimate of what USD$90.68 worth in Malaysian Ringgit today.

Compounded Tax

Albert Eistein once said, “Compound interest is the eighth wonder of the world”.

Albert Eistein once said, “Compound interest is the eighth wonder of the world”.

If you punch your calculator abit and work on the numbers abit, you will realise that USD$90.68 is actually 15.5% of USD$585. This is the magic of compounding. Just a tiny compounding from 5% makes an increased of 0.5% in total tax amount. Spare change to some, maybe?

Alternative to 15.5% Tax

You may want to consider saving the tax by buying silver bars instead. Silver bars fall under HS-code 7106, which is tax free. I recently received comments that custom officers may group silver rounds like Buffalo’s as a taxable coin; and this is upon their liking, no reason of any sort.

Thus, if you would like to make the most Ringgit out from your wallet, invest in silver bars instead.

All the best in your silver investment.

There's 2 Comments So Far

November 3rd, 2012 at 11:53 am

What about bring it back by ourselves after holidays from EUROPE or US? Say, in qtt not >4kg. Would it be a way to avoid the import tax?

November 7th, 2012 at 12:18 pm

Dear PC, if it is silver bar, it is non taxable regardless of the weight. However, if it is silver coins, it is taxable.