Mahathir: Currency should be pegged to Gold or Precious Metals

“2. But the business is spurious. The financial market is basically about gambling. Ever since America decided that the market should regulate itself, that there should be less Government, all kinds of unacceptable practices have been allowed. Short selling expanded from shares to commodities to currencies, Banks lend more money than they have and allowed highly leveraged borrowings by hedge funds and currency traders. They indulge in sub-prime loans, securing these imprudent lending by mortgaging and insurance.”

^ Suggesting currency should be pegged to Gold or other Precious Metals

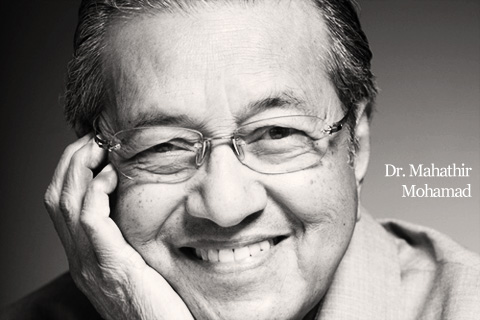

Again, we have it from our ex prime minister, bashing on the current financial mess in Europe and US. Dr. Mahathir has been unfavoured over hedge funds since the beginning. He often bash the practice of “leveraging” as creating money.

“9. If wages and salaries as well as bonuses and other perks are lowered, then the production of goods and services by the workers would cost less. The goods will be able to compete again in the markets against those of the East. Real businesses would then be able to be resuscitated.”

Today’s China, Japan and Korea are able to manufacture goods with quality as good as Europe but with half the cost. He suggested Europe to lower its wages and paychecks in order to compete with manufacturers from Asia.

“Currencies should be pegged to a new independent trading currency based on a specific amount of gold or other precious metal.”

Printing more or borrowing more will not solve the problem. It will turns it back and devalued its currency – just like what is happening today. Dr. Mahathir recommended currencies to be pegged based on gold or precious metals.

There's 1 Comment So Far

February 11th, 2012 at 1:38 pm

The problem is that the old gold-standard could not change human nature which dictates that no ruler can withstand the pressure to print more receipts than he has gold in reserve. The old gold-standard did moreover not provide for the possibility that an increase of the ounces, kilograms, or tonnes of gold held in reserve would lead to an increase in the currency’s value. Its chief weakness was however that it could be repealed by the politicians.

(Roland Leuschel and Claus Vogt, “Das Greenspan Dossier, Wie die US-Notenbank das Weltwährungssystem gefährdet. Oder: Inflation um jeden Preis”, finanzbuchverlag.de, 2006, 3rd ed., pp. 300 and 304)

The euro is the first currency that therefore has severed the link not only to gold but also to the nation-state,

said ECB president Duisenberg in 2002

(International Charlemagne Prize of Aachen for 2002

Acceptance speech by Dr. Willem F. Duisenberg, President of the European Central Bank, Aachen, 9 May 2002

http://www.ecb.int/press/key/date/2002/html/sp020509.en.html

Freegold means that the euro has a gold component and a paper component, and puts a “firewall” between both so that gold’s valuation as a wealth-preserving asset cannot be pulled lower by the inevitable inflation of the paper component of circulating currencies. It is the (quarterly) marking to market (MTM) of the gold reserves of the Eurosystem, not to the model of $42.2 like the USA central bank (originally $35), by the Eurosystem which provides that wall.

Gold is an item not related to euro monetary policy operations

.

Let gold trade freely behind the real firewall – like it did for the Ancients,

a wealth asset that stands beside money,

yet has no modern label or official connection to money.