Posted by KH »

Add Comment »February 19, 2012, johnni@thestar.com.my | A precious metals exchange has just been set up in Singapore by a Malaysian to help gold, silver and platinum bullion collectors not only to store their hoard but also to buy and sell such physical assets quickly and discreetly.

KEEPING gold bars and other precious items has reached a new level of sophistication in this region, with the launch of a storage facility in Singapore that offers clients anonymity as well as speedy transactions.

“The minimum deposit value in this bonded warehouse set-up is only US$1mil,” said Singapore Precious Metals Exchange Pte Ltd (SGPMX) founder and chief executive officer Victor Foo, 42.

“Of course, our clientele has much more than that to deposit,” added the Malaysian entrepreneur in an exclusive interview with The Star.

“SGPMX is located in The Singapore FreePort a super-secure facility and next to Changi International Airport. Within a free trade zone, the facility is dedicated to the storage and trade of precious metals, gems, artwork and other valuables.”

Safe location: SGPMX offers clients in Asia a bullion vault at an ‘offshore’ facility at a ‘much closer’ location than Switzerland.

Moving 100kg of gold from your house to KLIA is no laughing matter, said Foo.

“To clear a consignment at KLIA takes at least 45 minutes. But at Changi Airport, it takes only three minutes,” explained Foo, who has been involved in the insurance industry since 1991.

His financial planning services include gold bullion investments.

“If you are a high nett worth individual, you wouldn’t want to expose yourself and you don’t want your name to appear in the export papers.”

But the facility is a not a free-wheeling set-up as Foo is fully aware of the stringent regulations imposed by government authorities.

“We are not going to be laundering any blood money. Otherwise, the Singapore authorities will close us down,” he assured.

[Read more →]

Posted by KH »

Add Comment »

The people of Greece, Ireland, Italy, Portugal & Spain (PIIGS) are in €2.91 trillion Euros debt. So how much is €2.91 trillion? Take a look at the following visual.

This is a visual of 2 Billion Euros. At today’s rate, this is equivalent to 8 Billion Ringgit. We will need 4 giant trucks to tow it on our Malaysian road. One trillion is one thousand billion. To have one trillion Euros, you will be needing 500 of these monster truck. The total PIIGS’ debt is €2.91 and that’s about 1,455 trucks. Convert it to RM and you need an airport to accomodate 5,820 trucks loaded with our RM100 note!

To visualize further on how it would look like, head to demonocracy.info’s jaw-dropping infographics at http://demonocracy.info/infographics/eu/debt_piigs/debt_piigs.html

[Read more →]

Posted by KH »

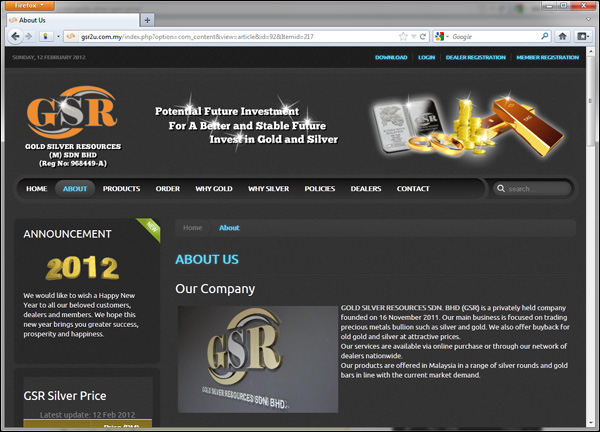

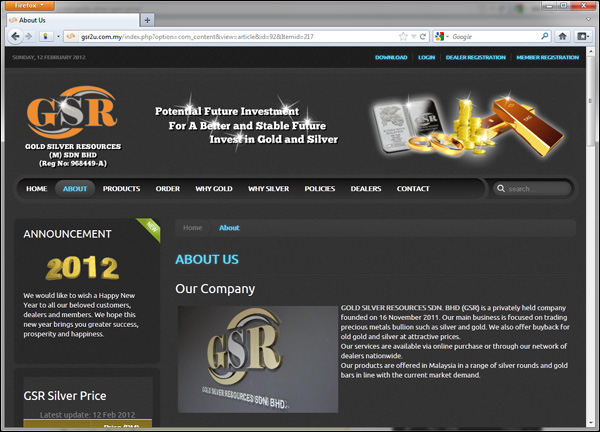

11 Comments »Here is an interesting development in our local scene lately. We have a new comer in providing locally branded silver by Gold Silver Resources Sdn Bhd.

^ GSR2u.com.my is by Gold Silver Resources Sdn Bhd Malaysia – Screen captured on 11-Feb-2012

Gold Silver Resources’ Background

Gold Silver Resources Sdn Bhd is a privately held company founded on 16 November 2011 and headquartered in Shah Alam. GSR is the initial for the company and just like how Tomei did it, they appended “2u.com.my” for their web address to make it truly Malaysian. With that, we have gsr2u.com.my. They product offering includes silver bars, silver rounds and gold jewelry.

^ Truly Malaysian – The Bunga Raya Malaysia and Harimau Malaya 1oz Silver Bar by GSR2u.com.my

GSR took the extra effort in making silver bars with local appearance. Currently, they have silver bars with Bunga Raya and Harimau Malaya emblem. They are scheduled to have Rhinoceros Hornbill and Dragon 1oz silver coins by sometime in February. Looks like GSR is also herding on the Dragon boat for 2012! Apart from that, they also have silver bars with various weight from 100 gram to 1 kilogram.

GSR’s Spot Price and Spread check!

Let’s do a quick calculation on GSR’s spot price and spread. At the time of writing, the silver spot price is USD33.59/ozt which is approximately RM102.90/ozt.

[Read more →]

Posted by KH »

Add Comment » Moose is the forth of a six-coin series of silver bullion coins celebrating Canada’s Wildlife minted by The Royal Canadian Mint. Of all thing, this design somehow reminded me of Abercrombie & Fitch’s logo. Previous Wildlife designs was “The Timber Wolf 2011″,”The Gizzly Bear 2011” and “The Cougar 2012”.

Moose is the forth of a six-coin series of silver bullion coins celebrating Canada’s Wildlife minted by The Royal Canadian Mint. Of all thing, this design somehow reminded me of Abercrombie & Fitch’s logo. Previous Wildlife designs was “The Timber Wolf 2011″,”The Gizzly Bear 2011” and “The Cougar 2012”.

It is limited to a mintage of one million coins. Two more issues are scheduled to follow for year 2013.

Ottawa, Ontario – February 3, 2012 – The Royal Canadian Mint’s is pleased to announce that its popular Canadian Wildlife 99.99% pure one-ounce silver bullion coin series is back, and bigger than ever, with a tribute to the moose: Canada’s largest land mammal. This latest addition to the Mint’s pure silver bullion collection was launched today at the World Money Fair in Berlin, Germany before a premier gathering of the world’s mints, distributors and buyers.

[Read more →]

Posted by KH »

1 Comment »“2. But the business is spurious. The financial market is basically about gambling. Ever since America decided that the market should regulate itself, that there should be less Government, all kinds of unacceptable practices have been allowed. Short selling expanded from shares to commodities to currencies, Banks lend more money than they have and allowed highly leveraged borrowings by hedge funds and currency traders. They indulge in sub-prime loans, securing these imprudent lending by mortgaging and insurance.”

^ Suggesting currency should be pegged to Gold or other Precious Metals

Again, we have it from our ex prime minister, bashing on the current financial mess in Europe and US. Dr. Mahathir has been unfavoured over hedge funds since the beginning. He often bash the practice of “leveraging” as creating money.

[Read more →]

Moose is the forth of a six-coin series of silver bullion coins celebrating Canada’s Wildlife minted by The Royal Canadian Mint. Of all thing, this design somehow reminded me of

Moose is the forth of a six-coin series of silver bullion coins celebrating Canada’s Wildlife minted by The Royal Canadian Mint. Of all thing, this design somehow reminded me of