Posted by KH »

1 Comment »In this post, we will investigate in details our 3rd series coins. This is in response to my previous post, 10 facts about Malaysia’s new 3rd series coins. I will share with you how I discover my facts.

^ I was at Bank Negara yesterday to check out the new coins first handed

The engineering of my facts are simply breaking down the metal content of the coin in percentage and matches it with current metal market price. Four metals are involved in today’s baking lesson. They are namely Nickel, Copper, Zinc and Stainless Steel. Sadly, none of them are in the precious metals group.

Let’s crunch some numbers.

[Read more →]

Posted by KH »

1 Comment » If you are a fan of Transformers, you might be interested in these. Yes, not only does dark moon has Transformers, Perth Mint Australia has them too! You can order them directly at Perth Mint’s website.

If you are a fan of Transformers, you might be interested in these. Yes, not only does dark moon has Transformers, Perth Mint Australia has them too! You can order them directly at Perth Mint’s website.

It cost AUD$299 to buy them today. Convert that to with today’s rate against Australian dollar of 3.25, it’s about RM971.75. You can have them directly shipped to your Malaysian address but it’s subject to 5% import and 10% sales tax (approx RM145.76). With that, your total cost rounds up to RM1,117.5. That’s about RM372.5 for one piece of Optimus Prime coin.

[Read more →]

Posted by KH »

6 Comments »So that now you have decided to buy silver bars for your investment and yet you are stuck at another cross road.

“With so many types of silver bars in the market, which one should I buy”

To answer the above question, it is best that we look into what’s available in our market. Not all silver bars are made equal. I have noticed a few particular brands are more popular here than others. Over the course of my own research, I have summarized that the following silver bars are among Malaysian’s favourites.

To answer the above question, it is best that we look into what’s available in our market. Not all silver bars are made equal. I have noticed a few particular brands are more popular here than others. Over the course of my own research, I have summarized that the following silver bars are among Malaysian’s favourites.

They are:

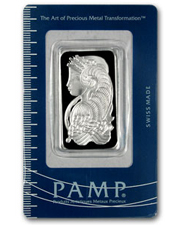

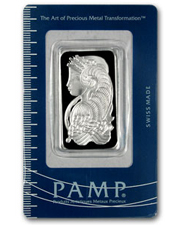

- Pamp Suisse Silver Bars

- Scottsdale Silver Bars

- Sunshine Silver Bars

- Silver Towne Silver Bars

PAMP Suisse Bars – The Royce Rolls

If you must know, PAMP stands for Produits Artistiques Métaux Précieux, which in French means artistic, precious metals products. With that alone, it’s worth the extra dollar. Not only is the PAMP Suisse bar one of the most popular bullion in the world, it is also one which carries a very high premium.

If you must know, PAMP stands for Produits Artistiques Métaux Précieux, which in French means artistic, precious metals products. With that alone, it’s worth the extra dollar. Not only is the PAMP Suisse bar one of the most popular bullion in the world, it is also one which carries a very high premium.

While a generic silver bar may sells at around 2-4 dollars above spot price, PAMP Suisse bars are sold at 20 dollars above spot price. They don’t call her the Royce Rolls of silver bars for nothing. Buy in bundles of 25s, and the ladies will come with a nice outer box.

… and that lady in the bar, her name is Lady Fortuna.

Official website: https://www.pamp.com

Scottsdale Silver Bars – The Stackers

Scottsdale Silver bars are easily recognisable by their distinctive lion logo on all their bars. They are made in USA with prefectionist manufacturing. Portion of their silver are recovered thru recycling activities from the photography and manufacturing industry.

Undoubtedly, “The Stacker” would be Scottsdale Silver’s signature product. Scottsdale Silver’s “The Stacker” stacks nicely ontop of each other making it easy, neat and space-saving for storage. Stackers come in various weight: “The Stacker (10oz)”, “The Kilo Stacker (1kg)” and “The King Stacker (100oz)”. All are authorized for use in IRA by the Internal Revenue Service of the United States of America and are ISO-9000-2008 certified.

Think IRA (Individual Retirement Account) as the American’s version of KWSP. Americans has the option to buy precious metals as part of their government backed retirement plan.

Official website: http://scottsdalesilver.com

[Read more →]

Posted by KH »

Add Comment »I received 2 messages from my MSN messenger yelling in joy, “Gold hit $1,600 an ounce! WOW!”… A quick check into my inbox and I have few newsletters on gold hitting the new high of $1,600/oz as well. So, what’s the big deal really?

^ Screen capture from goldprice.org website.

Everybody is expecting gold to go further than $1,600. Do a quick google search and you’ll probably see pages of prediction of gold hitting $2,000, $2,500 or even more than $3,000 an ounce. So really, what’s there to shout when it’s $400 short from the $2,000 target?

[Read more →]

Posted by KH »

3 Comments »It’s crucial to understand how does spread works before we start investing in precious metals. Spread in short means the margin between the buying and selling price. The formula is as followed:

Formula for spread:

(Sell Price – Buyback Price)/Buyback Price X 100 = Spread %

Example of calculation:

1 oz of Kijang Emas selling at RM5,060, buying back at RM4,864.

Apply the formula and therefore it’s: (5060 – 4864)/ 4864 x 100 = 4.03%

With that, the spread for 1 oz of Kijang Emas is 4.03%.

The higher the spread translate to the more ‘expensive’ it is to trade with the vendor while the lower the spread is the vice versa. Many of the time, we won’t feel the pinch immediately after purchasing our bullion. This is because most of the time, we don’t sell it back on that day same day that we bought. But if you happened to do that for whatever reason, you will immediately lose out the spread. This is where the vendor makes their profits.

[Read more →]

If you are a fan of Transformers, you might be interested in these. Yes, not only does dark moon has Transformers, Perth Mint Australia has them too! You can order them directly at

If you are a fan of Transformers, you might be interested in these. Yes, not only does dark moon has Transformers, Perth Mint Australia has them too! You can order them directly at  To answer the above question, it is best that we look into what’s available in our market. Not all silver bars are made equal. I have noticed a few particular brands are more popular here than others. Over the course of my own research, I have summarized that the following silver bars are among Malaysian’s favourites.

To answer the above question, it is best that we look into what’s available in our market. Not all silver bars are made equal. I have noticed a few particular brands are more popular here than others. Over the course of my own research, I have summarized that the following silver bars are among Malaysian’s favourites. If you must know, PAMP stands for Produits Artistiques Métaux Précieux, which in French means artistic, precious metals products. With that alone, it’s worth the extra dollar. Not only is the PAMP Suisse bar one of the most popular bullion in the world, it is also one which carries a very high premium.

If you must know, PAMP stands for Produits Artistiques Métaux Précieux, which in French means artistic, precious metals products. With that alone, it’s worth the extra dollar. Not only is the PAMP Suisse bar one of the most popular bullion in the world, it is also one which carries a very high premium.