What is Operation Twist?

Continuing from my previous post, the video above is a detailed explanation of what Operation Twist is all about.

Continuing from my previous post, the video above is a detailed explanation of what Operation Twist is all about.

An interesting video on money creation I found in youtube. The first part of the video explains how the money system works. The second part of the video highlights the First National Bank of Montgomery vs Jerome Daly case which is also known as the 1968’s Credit River Case.

While Bank Negara has updated our coins to stainless steel, the United State is busy printing their new $100 dollars.

The United State’s new $2.4 trillion dollars will look like this:

We had an exciting week last week. You should by now know that US is at risk of diving into a deep recession soon.

^ President Obama: Mmm… no more AAA? You must be kidding me.

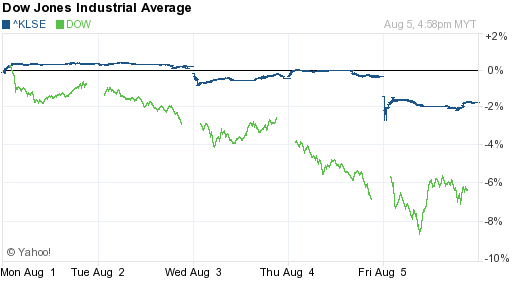

Last Thursday we had our worst drop in DOW since 2008’s subprime mortgage crisis. The DOW went to the lowest of -8% before ending the week of bad news with -6%. When we Malaysian woke up on Friday, KLSE join the bear rush and ended the Friday with a -2% retreat.

^ Financial graph from Yahoo! Finances

America continued their Friday with rebounce only to be hit by another uppercut. Standard & Poor’s downgraded US credit card from brilliant AAA to AA+. Not just any AA+, its AA+ with negative outlook.

It’s going to be a hot sizzling Monday today. Washington now has one more day to solve the puzzle before the debt burst. Unless they come out with a fire-fighting plan, US will start defaulting on their record-breaking $14.46 trillion debt by tomorrow.

In short, the more money the Fed prints OR the weaker the dollar is the better it is for the PM market. That would happen if US raises their debt ceiling or decided to start defaulting its current debt. That’s the bull camp.

If Washington are able to stop ballooning their $14.46 trillion ceiling, not default its current debt AND turn their Federal P&L from red to black – that spells the bear for PM. Been spending my entire weekend catching up the debt news and to have THAT, is almost unlikely.

Following are some materials that would go along well with your morning coffee.