Understanding Spread for Buying and Selling Gold or Silver

It’s crucial to understand how does spread works before we start investing in precious metals. Spread in short means the margin between the buying and selling price. The formula is as followed:

Formula for spread:

(Sell Price – Buyback Price)/Buyback Price X 100 = Spread %

Example of calculation:

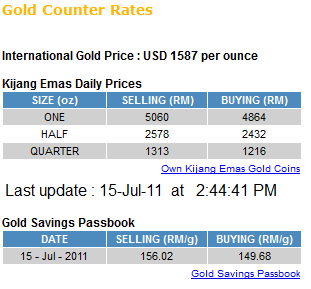

1 oz of Kijang Emas selling at RM5,060, buying back at RM4,864.

Apply the formula and therefore it’s: (5060 – 4864)/ 4864 x 100 = 4.03%

With that, the spread for 1 oz of Kijang Emas is 4.03%.

The higher the spread translate to the more ‘expensive’ it is to trade with the vendor while the lower the spread is the vice versa. Many of the time, we won’t feel the pinch immediately after purchasing our bullion. This is because most of the time, we don’t sell it back on that day same day that we bought. But if you happened to do that for whatever reason, you will immediately lose out the spread. This is where the vendor makes their profits.

Now that we understand what spread is, let’s investigate some of the spread available in our shore. The gold closed at USD$1,593.00/oz while the silver is at USD$39.23/oz as I am typing this. The above example is actually the actual buy/sell price from Maybank. Let’s us deep dive into the rest of the sizes available for Kijang Emas.

^ Screen capture from maybank2u.com.my website.

- 1 oz Kijang Emas: sells RM5,060, buys RM4,864, spread 4.03%

- 1/2 oz Kijang Emas: sells RM2,578, buys RM2,432, spread 6.00%

- 1/4 oz Kijang Emas: sells RM1,313, buys RM1,216 spread, 7.98%

It’s clear that the smaller the coin, the higher the spread is. This is expected as the cost of minting and workmanship for smaller coins are as expensive as the bigger one. It would be more cost effective to buy larger pieces.

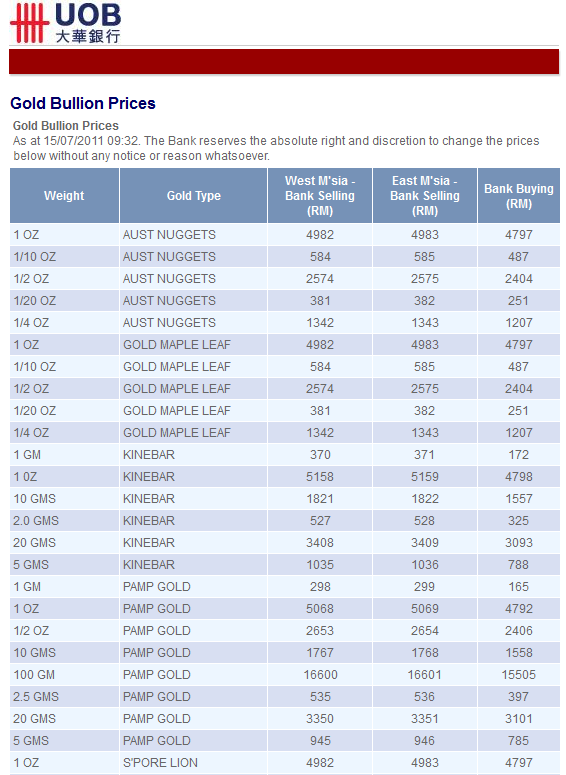

Let’s take a look at what is under the sleeves of UOB on their bullion offering. Let’s just do a quick calculation on their spread based on last Friday’s price and see how it goes.

^ Screen capture from UOB.com.my website.

- 1 oz Australian Nuggets: sells RM4,982, buys RM4,797, spread 3.85%

- 1 oz Canadian Maples: sells RM4,982, buys RM4,797, spread 3.85%

- 1 oz KINEBAR: sells RM5,158, buys RM4,798 spread, 7.50%

- 1 oz Pamp Suisse: sells RM5,068, buys RM4,792, spread 5.75%

- 1 oz Singapore Lion: sells RM4,982, buys RM4,797, spread 3.85%

With that, we can concludes that in UOB offering, the Nuggets, Maples and Lion has the lowest spread. Kinebar and the pretty Pamp Suisse is nice to have but it comes with a hefty premium to pay. Based on this calculation, I recommends buying the Nugget and Maples for being internationally recognized and with slightly lower spread than our local Kijang (0.17% to be exact).

Let’s move on to public gold and see how does their spread goes.

^ Screen capture from publicgold.com.my website.

- Gold 10 gram: sells RM1,731, buys RM1,593, spread 8.66%

- Gold 20 gram: sells RM3,429, buys RM 3,223, spread 6.39%

- Gold 50 gram: sells RM8,533, buys RM 8,064, spread 5.815%

- Gold 100 gram: sells RM16,987, buys RM 16,138, spread 5.26%

- Gold 250 gram: sells RM42,267, buys RM 40,365, spread 4.71%

To enjoy the lowest spread in public gold, buy 250 gram of gold or more. However, in comparison, it’s still more expensive than Kijang Emas and few bullions offered by UOB. If you have a budget to spend on a 5.75% spread, get a Pamp Suisse from UOB. Pamp Suisse is definately a much nicer product.

How about silver? Let’s see!

^ Screen capture from publicgold.com.my website.

- Silver 250 gram: sells RM 1,233, buys RM1,048, spread 17.65%

- Silver 500 gram: sells RM2,466, buys RM 2,096, spread 17.65%

- Silver 1 kilogram: sells RM4,932, buys RM4,192, spread 17.65%

As expected, the spread of silver is much higher compared to gold. This is mainly due to the nature of silver market which are prone to daily volatility. It doesn’t really matter what size of silver you buy with public gold. It’s all the same spread. It would be wiser to buy smaller chunk instead of a large one for liquidity.

So there we have it. A simple calculation formula that every investor should know.

That’s all for now. Have fun punching your calculator.

Cheers.

There's 3 Comments So Far

February 2nd, 2012 at 8:12 am

TQVM for the article. Is it still ok to keep some silver chunks.

March 26th, 2012 at 11:35 pm

CM Loh: Anytime is a good time to buy. Use dollar-cost-averaging to average out your investment 🙂

Who Linked To This Post?